Information

October 15, 2020

Binnenkort moeten de aangiftes niet-inwoners natuurlijke personen worden ingediend. Op zich niet altijd evident omdat de belasting niet-inwoners vol valkuilen en wolfsijzers zit. Het al dan […]

July 1, 2020

In this article, we provide an update on the measures, taken by the tax authorities to cope with the impact on the travel restrictions for employees, […]

April 29, 2020

Meer en meer werkgevers en hun medewerkers worden geconfronteerd met de mogelijke fiscale impact van thuiswerk in situaties waarin de werknemer in normale omstandigheden over de […]

April 27, 2020

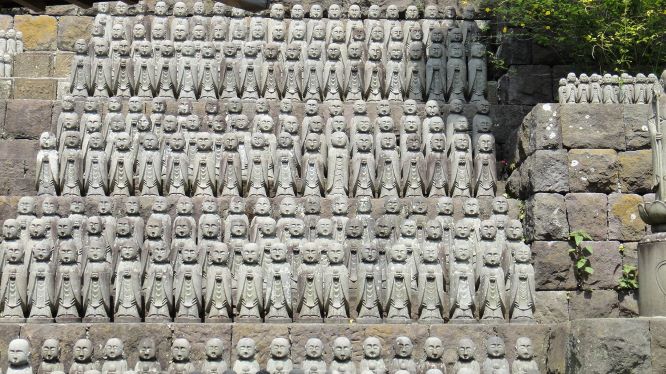

A new tax treaty was signed between Belgium and Japan on 12 October 2016. Tax treaties do not immediately enter into force, and we had to […]

April 15, 2020

The question on how to apply article 15 of the OECD tax treaties during the current period of forced working at home is a big concern […]

April 9, 2020

Gezondheid en werkorganisatie zijn momenteel de thema’s van de dag. Jammer genoeg betekent dit niet dat er plotseling geen belastingen meer bestaan. De recente maatregelen inzake […]