Inspiration

April 29, 2020

Meer en meer werkgevers en hun medewerkers worden geconfronteerd met de mogelijke fiscale impact van thuiswerk in situaties waarin de werknemer in normale omstandigheden over de […]

April 27, 2020

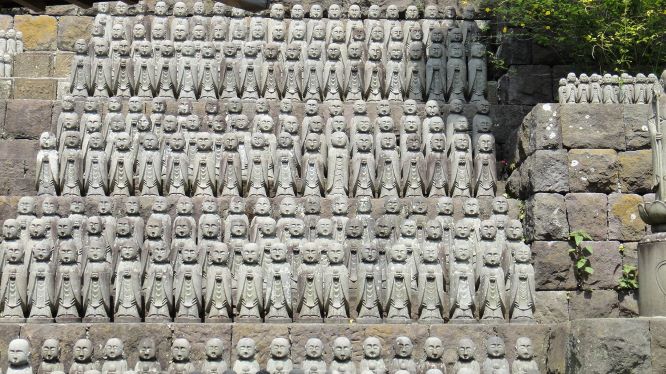

A new tax treaty was signed between Belgium and Japan on 12 October 2016. Tax treaties do not immediately enter into force, and we had to […]

April 15, 2020

The question on how to apply article 15 of the OECD tax treaties during the current period of forced working at home is a big concern […]

April 9, 2020

Gezondheid en werkorganisatie zijn momenteel de thema’s van de dag. Jammer genoeg betekent dit niet dat er plotseling geen belastingen meer bestaan. De recente maatregelen inzake […]

March 30, 2020

The recent outbreak of the Corona crisis may have a significant impact on the overall income tax situation of individuals, who were either sent by their […]

April 10, 2019

Een individu kan in België belastbaar zijn in de personenbelasting dan wel in de belasting van niet-inwoners. De personenbelasting is van toepassing op rijksinwoners, daar waar […]