Communal tax for non-residents?

Communal tax for non-residents?

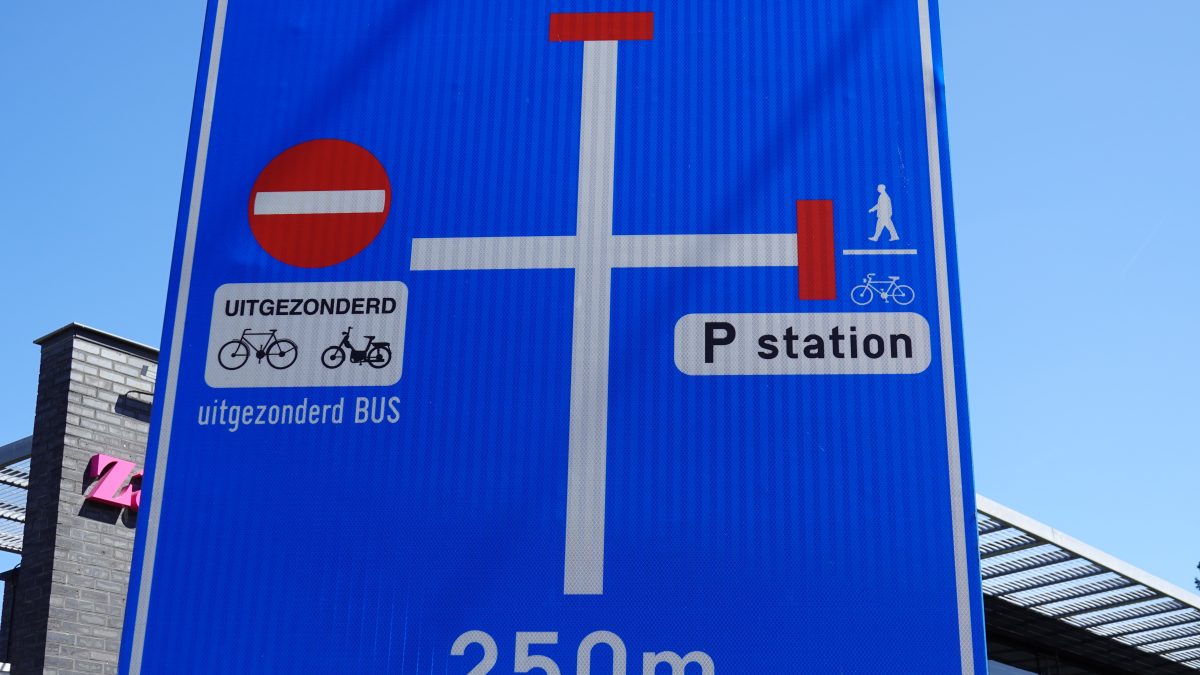

Traffic in Gent - there is no way out!!

Residents of Belgian pay income taxes at multiple levels: federal tax, regional tax and finally also the commune tax.

The commune tax is collected at national level, but the revenue is subsequently remitted to the commune, where the taxpayer is residing. The tax is not calculated on the taxable income of the taxpayer, but is a percentage of the sum of the federal and regional tax. The rate is defined per commune, and tends to fluctuate around 7%, though significant variation is possible and a few communes even have a 0% tax rate. The communal tax is used by the commune to fund local expenditure to the benefit of the inhabitants of the commune.

Non-residents of Belgium obviously do not reside in any of the Belgian communes, so there is no need to fund any Belgian commune with a communal levy. Nevertheless on their tax assessment a line always appears, indicating a so-called ‘communal tax’ of 7%. This line on the tax assessment is misleading because this is no communal tax at all but instead is a supplementary federal tax, that is disguised as a communal levy. So actually non-residents contribute more into the federal tax as compared to residents, who pay part of their tax to a commune and thus pay less to the federal level.

The question arises why non-residents should pay this levy. Indeed, the revenue is not used to fund expenses at communal levy and it would be fully logical that this tax is not charged to non-residents. For decades throughout my career I was puzzled why nobody seems to be able to successfully challenge this strange levy.

In this way, the issue came up in 2009 in the question of Mr. Kovács in the European Parliament (E-3437/2009 (ASW)). Unfortunately, he raised the question on behalf of residents of The Netherlands. For them, it was pointed out that the matter is not relevant because the tax treaty between Belgium and The Netherlands offers a compensation to Dutch residents for the tax difference between both countries, including the communal tax. The issue could therefore easily be dismissed on this basis.

The matter was thereafter raised with the Belgian Constitutional Court (decision of 6 June 2019). The decision of this Court in our opinion is rather poor as reference was made to the fact that non-residents can also benefit from all facilities and services, offered by the Kingdom of Belgium in order to render their services in the country. This was deemed to be sufficient justification for the so-called communal levy to the benefit of the federal revenue.

The validity of this argument can be challenged. Indeed, non-residents need to pay more tax to the federal level (base tax plus the so-called communal levy) as compared to residents (for them only the base tax goes to the federal level), while the Belgian State does not offer any additional facility or service to non-residents as compared to residents. It is even likely that non-residents will benefit less from the Belgian State services, as for many public services they will rather rely on their own country of residence.

A next phase in this tenacious discussion now came up in 2024, this time for French residents, who cannot benefit from a similar compensation as compared to their Dutch colleagues. The Court of Appeal of Liège filed a request for a prejudicial question with the European Court of Justice to check whether the tax is in line with the free movement within Europe. It will be interesting to see whether this questionable levy will remain after a critical review by the European Court of Justice.